Today, the construction industry is facing fundamental challenges, with soaring prices for building materials and supply chain challenges that have put many projects at risk and, for some firms, their survival as a whole. The implementation of many projects simply turned out to be unprofitable, in view of the unpredictability of these two factors, and not many really can withstand such a blow.

Below we provide a summary of the current overview of the rise in prices for materials from The Construction Association AGC https://www.agc.org/

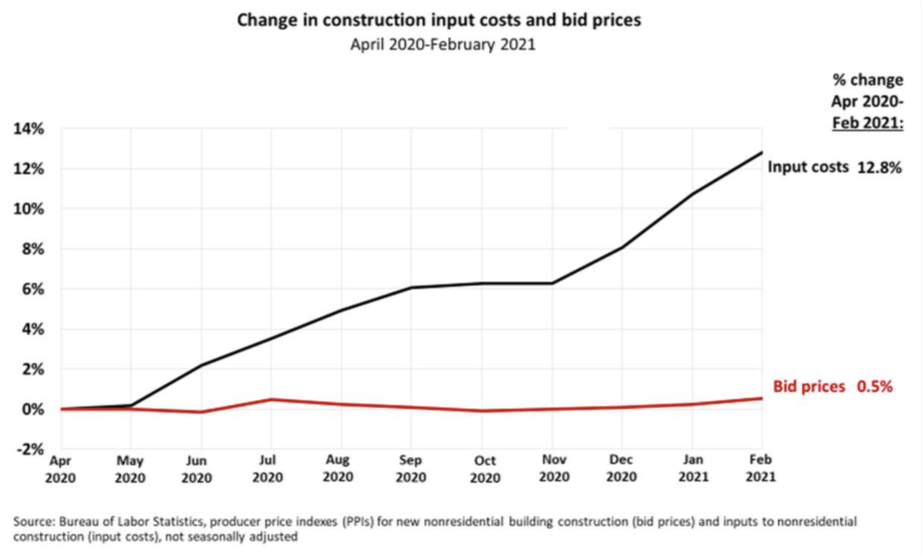

Manufacturing costs for general contractors rose nearly 13% from April 2020 to February 2021.

Figure 1 illustrates the threat to contractors from fast and steeply rising prices for materials, both for projects that have already been bid or started and for preparing -price or guaranteed-maximum-price bids.

The red line shows the change since April 2020 in the price of all materials and services used in nonresidential construction, while the blue line measures the change or lack of change in what contractors say they would charge to erect a set of nonresidential buildings. This blue line, essentially a measure of bid prices, has remained virtually stable, rising only 0.5% from April 2020 to February 2021. In contrast, the red line, measuring the cost of contractors’ purchases, has soared nearly 13% over the same 10 months.

Due to extreme weather conditions and general demand, PVC prices have increased over 270% from March 2020 to March 2021

Some broad categories of products have not gone up dramatically, but narrower classes of products within those categories have. For instance, the PPI for plastic construction products rose “only” 6% from March 2020 to January. But an AGC member reported on March 5 that for polyvinyl chloride (PVC) “used in electric utility work the price from [March 2020] to January 2021 had a general increase of 85%.” Following extreme winter weather in Texas that knocked out production facilities and created a surge in demand for pipe to replace broken lines, “Now that increase is 270% from March 2020” to March 4, 2021.

Housing starting costs have increased between 15% to 20% from year-earlier levels

The pandemic has caused current production and delivery of many materials to fall short of demand. Initially, a wide range of factories, mills, and fabrication facilities were shut down on their owners’ initiative or because government orders deemed them to not be “essential.” In some cases, contractors—particularly homebuilders—canceled orders because they no longer saw demand for construction. Once production facilities were allowed to re-open, many of them had trouble getting up to full capacity because their own workers or those of their suppliers and freight haulers may have been ill, quarantined, or required to care for family members at home. Imported products and components also were subject to production and shipping shutdowns in the early months of the pandemic. This particularly affected many products from China and northern Italy, ranging from kitchen cabinets and appliances to tile flooring to elevators. In recent months, production has increased but containers, ships, port space, and trucking capacity have all experienced bottlenecks that have slowed deliveries. Dramatic shifts in demand triggered, at least in part, by the pandemic have added to price pressures and shortages of goods.

Residential construction spending jumped 21% from January 2020 to January 2021

The construction market currently is marked by a huge disparity. Residential construction spending comprising new single and multifamily structures along with additions and renovations to owner-occupied housing jumped 21% from January 2020 to January 2021. Over the same 12 months, private nonresidential construction spending tumbled 10%.

Employment data show a similar story. Both residential and nonresidential construction employment plunged by 14-15% from February to April 2020. But over the next nine months, through January 2021, employment among residential building and specialty trade contractors rebounded to the same level as in February 2020, immediately before the pandemic struck. In contrast, in those nine months nonresidential building, specialty trade and heavy and civil engineering contractors added back little more than half of the employees they lost between February and April 2020.

Source https://www.agc.org/sites/default/files/AGC 2021 Inflation Alert_0_0.pdf

Such global changes in the industry require company owners to pay special attention to the situation, to react quickly and to work seriously in relation to risk management and financial management. The crisis always suits the redistribution of the market, and here companies are divided into 2 camps, the weak are blown away by the shock wave and companies that are not ready for changes are left behind, freeing up the market for strong players. The crisis is the time of opportunities and one of the main tasks of the entrepreneur is to use them.

In our blog, we have already published several articles that can be useful in developing your business in a crisis situation and introducing changes. Most of the actions that will help the company develop during this period are associated with competent process management and optimization. Many processes can be optimized by integrating IT solutions of varying degrees of complexity, but often the development of complex personal systems hits the company’s budget hard, although such solutions undoubtedly pay off, now many companies do not have the opportunity to invest large-scale budgets in the future and solutions are needed here and now and within the possibilities. Our company will soon present a universal solution that will allow small and medium-sized businesses to reach a new level in process management, including such important ones as cost management.

You can follow our updates or contact us to learn more about the solutions we offer.